I’m a communications major and I hope to work in marketing one day. I pay for college through financial aid and government loans. The thing I struggle with most about the cost of college is definitely paying for living costs while in school as the aid does not cover dorming for things like transit and food costs.

Posts Tagged ‘student loans’

Shifa Giash, City College of NY

Michael Blackson, SUNY Cortland

Through my personal experiences, growing up/ living in D.C., and even my high school it would all lead to me taking the leap and studying history here at SUNY Cortland. Post college I am seeking to work in the field of public history, public speaking, or governmental work. Though I wish I could live comfortably like other countries with free or even cheaper I still do have to pay for college through a combination of loans and paying for scholarships. In addition I have to work at least 20 hours week just to survive without any extra amenities.I am not eligible for TAP because I am a resident of D.C. not New York.Both luckily and unfortunately I am the first person to go to college. With this comes with the burden of setting examples to come and having no support or advice on college life. Paying back the school and other expenses simultaneously is the biggest challenge with college because it puts so much stress and anxiety on me about in and post college. I can’t always do all of the fun things my friends re doing because I don’t have networks of money. All of my time is for business never leisure.

Deangela Green, Purchase College

I’m a sophomore at Purchase studying communications and pay for my education both out of pocket and through student loans. I wish there was more support and help for TAP application and loans. I’d like to change the help provided and more easily accessible for questions I may need and I’ve struggled with not having enough information to fill out my FAFSA. I struggle with transportation and bills and trying to pay for books and materials needed for class

Dillon Jones, SUNY Cortland

I am currently a senior doing History Major with a Political Science Minor. I have no dream job with my major. My parents cover my living cost and some tuition however most of the money is from a private student loan. I don’t receive anything from the TAP program. Most family members have gone to college and graduated so I feel obligated to do the same thing. For freshmen and Sophomores a lot of classes that are needed may be gone because they get the last picks. Parking has been a major issue for the people on the top part of campus. it seems like the sports buildings are much better funded than the others. Book store return policy is a pain. If you miss the week of returns they make it very difficult to return them.

Chris Rocco, Purchase College

My name is Chris Rocco, I graduated from Purchase College in December of 2015, and am still paying off my student loans. After 8 years, I have barely put a dent in the loan and will most likely be paying for the next decade or more. The cost of tuition in the US is astronomical, and there is no guarantee of a career after graduating. I know many people who barely make ends meet and struggle paying off their loans, and others who didn’t go to college just so that they could avoid the debt that carries over. There are thousands of people in the US who do not have the privilege of attending college due to the high cost associated with it, and it is limiting their potential and preventing them from opportunities. While others are stricken in student loan debt because the schools encourage them to “follow their dreams”. The system is flawed and must be changed.

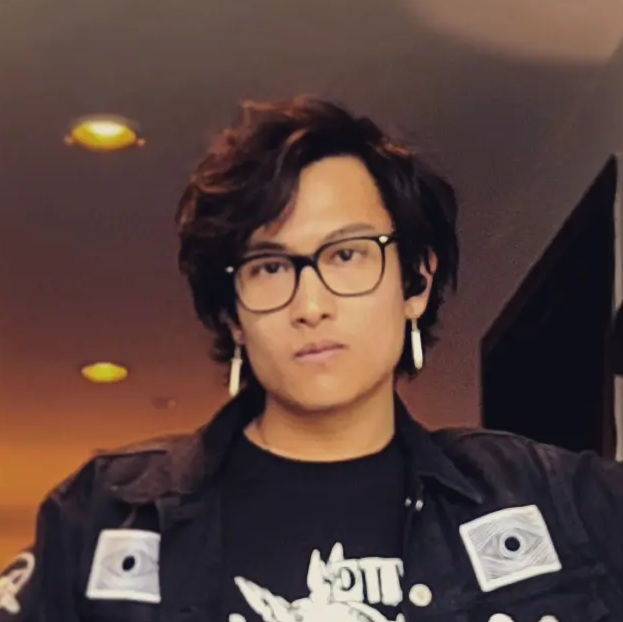

Justin Yulo, City College of NY

I’m student here at City College New York and I think I can benefit from a free CUNY and more importantly other students can benefit from a free CUNY because the cost of going to university here, while CUNY is an affordable university, it is still pretty expensive for some, especially low income families. In my case I still have to take out student loans, in the 10,000s attending here, and even right now I still have to take a part time job just to pay for some of the expenses like the transport and travel with my metrocard and overall I think a free CUNY builds an important part of our society which is the next generation coming up and learning in such a prestigious university that boosts communities.

Abby Bang, SUNY Cortland

Hi, my name is Abigail Bang. I decided to go to SUNY Cortland because I was recruited for gymnastics. Also, it has a very good sports management program and they’re one of the tops in the nation. I am currently studying sport management with a concentration of facility and event management. My plans for the future are to be a personal trainer and a gymnastics coach on the side for higher level athletes. My parents are paying for the first year of school and I am paying for the rest through student loans. I have to pay for gas, food, and my rent comes out of my savings. I do have to work to cover expenses, and what I do is Instacart, personal training, and I work at a club gymnastics center in Syracuse. I work roughly 15 hours a week and three jobs total. College during a global pandemic was very mentally challenging because all of my classes were online while I was also working a full time job. Getting a college degree to me means that I am much more likely to get a job in the sports industry because people look for college degrees. I am kind of worried about paying back student loans. I do not receive financial aid. Based off of Cortland, I’ve had a very good experience with my professors because they care about us, other professors have challenged me a lot because they don’t care as much, especially after covid was over.

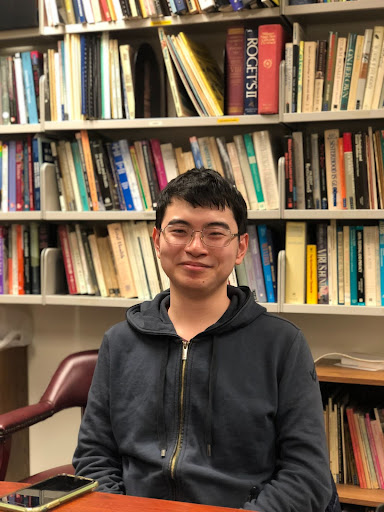

Andy Huang, Hunter College

I am a senior studying chemistry at Hunter College. I chose to attend a CUNY because it was much more affordable than a SUNY or private college. I live with my parents as dorming would be too expensive. I am lucky to receive the Pell Grant and TAP, both of which help cover my tuition fees. I also receive a scholarship per semester that helps fund my transportation, school materials, and food. While I rely on financial aid, I have come close to losing it during several semesters. This semester specifically, I was stressed about financial aid because I lost TAP. I couldn’t receive it because I was not taking enough eligible credits (the classes I needed to take were locked to the spring semester). I hope to see TAP’s eligibility expand in the future so that it accepts all the classes that students take. Attending college and getting a degree should not be blocked by tuition fees. Students need to be able to focus more on studying instead of stressing about working part-time/full-time to attend their classes.

Caroline Scott, SUNY Cortland

I attend SUNY Cortland as a full-time student. I’ve been here for two years and attended SUNY Broome my freshman and sophomore year. When applying for college I didn’t know where I wanted to go, but I knew that I didn’t want to be that far from home. That’s why I decided on Broome because it’s about 30 minutes from home. I was able to live off campus and not commute so I was able to get a real college experience. After two years there I decided to go to Cortland because it was far from my home where I am able to be independent, but still close enough to go home if I need to. I am able to go to Cortland without having to have student loans because my parents can pay for it in full. That is a reason why I chose Cortland because I wouldn’t have student debt. Cortland comes with a lot of expenses though whether it’s parking, the price of textbooks (which I don’t always need), or materials teachers make us get outside of the classroom. My major is important to me so I will do whatever it takes to obtain my degree, but the price for many things have gotten out of control and I believe all SUNYs need to look at their finances and think about their students.

Justin Lorenzo, Purchase College

I’m a junior and intern for NYPIRG at SUNY Purchase College. I am a communications major and Economics minor. When I graduate I hope to pursue the sports advertising business. What inspired me to choose my major and minor was my love for baseball and wanting to work for a professional Sports team in the future. I currently use loans to pay for College. I’ve used TAP twice and have had a positive experience with it. I have 4 siblings and I am currently the 3rd one who has attended college. As of financial aid, it does cover me fully with loans. I usually work full time in the summer to catch up with the loans. I’m not worried about paying my loans, Just worried about what career I will have.