I am a sophomore studying digital design, I hope to get a job in animation. I pay for my tuition through financial aid. I am the first in my family to go to college and it’s a little stressful as I feel there’s a lot of pressure to be better than the people in my family as I’m a first generation. Some of my biggest financial costs have been paying for transportation, food and textbooks which is where I have to spend a lot of the money I earn working. I also have issues with our escalators and elevators often not working.

Posts Tagged ‘textbooks’

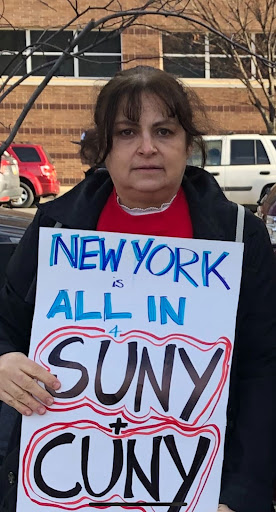

Genesis Ramos, City College of NY

Isaac Johnson, SUNY Purchase

I am a senior studying liberal studies looking to get into business. I pay for my tuition with financial aid, loans and paying out of pocket. I would like to extend the years and money that is allowed to to be received from TAP. For example students who are in college a little longer than the regular 4-5 years aren’t allowed to receive some financial aid. Everything has been a big challenge for me due to the fact that I don’t receive certain financial aid programs and is paying out of pocket while being a full time student athlete. Transportation, food, textbooks all cost a lot of money while I am still paying for my tuition on my own.

Steven Espinoza, Hunter College

I’m a political Science major at Hunter graduating this semester. I paid for my higher education through FAFSA. I’d want TAP to be more proactive in notifying students to file, or even of its existence. I feel like there are students are unaware of TAP. One of my biggest issues is transportation costs. I didn’t have enough money to pay for a swipe and the train was coming, so instead of refilling my card I jumped the turnstile. Cops pulled to the side and gave me a ticket instead of a warning, which was so frustrating because it was hard to pay that ticket off. I almost never paid for a textbook or book in college just because some of the prices were outrageously high. I always relied on student networking (group chats, classroom) to share the textbook/book with me. It’s frustrating to see that professors are prevented from sharing the textbook for free for their students. Honestly, the worst experience at Hunter is the support system. It’s so bureaucratic and burdensome, I can’t speak with an adviser without having to send an email or make a virtual appointment. I’ve never seen my advisor or talked to my advisor, until my final semester. These offices are not welcoming to students and reminisce the same vibe as a DMV. There’s also issues with the infrastructure is terrible, I was constantly reminded of it every where I walked in Hunter. It really feeds into the stigma of public schools. The elevators are consistently useless, it’s honestly faster to take the stairs.

Dillon Jones, SUNY Cortland

I am currently a senior doing History Major with a Political Science Minor. I have no dream job with my major. My parents cover my living cost and some tuition however most of the money is from a private student loan. I don’t receive anything from the TAP program. Most family members have gone to college and graduated so I feel obligated to do the same thing. For freshmen and Sophomores a lot of classes that are needed may be gone because they get the last picks. Parking has been a major issue for the people on the top part of campus. it seems like the sports buildings are much better funded than the others. Book store return policy is a pain. If you miss the week of returns they make it very difficult to return them.

Elizabeth Estony, Purchase College

I am a junior getting aAnthropology/Media Studies/Philosophy BA at Purchase College. I work three jobs at school to help my parents pay for my education. My mom and dad also work multiple jobs. I get a scholarship from my Mom’s job, and the steaks are super high to maintain. This means I have to balance three jobs, an internship, and receiving high marks in all my classes which has been one of the most challenging things about attending college. I have experienced issues with affording the non-tution costs of getting my college education. For my majors there are many events off campus we need to attend such as museums, lectures at other colleges, and many books we are required to read. There is a push for professors to use the library’s course reserve where PDF’s can be published and printed. Some professors just refuse to use this resource which is incredibly frustrating because they will require multiple books only available on amazon. I have many required classes that I need to graduate but they meet at the same time every semester. Also many of my professors take leaves, or are spread too thin in their department due to adjunct professors not getting paid livable wages.At my school many of the buildings do not have proper heat or air conditioning, and the President will simply tell us to bundle up. Tiles are missing on pathways, and there are windows that have been broken for several semesters now. I am a tour-guide at Purchase and honestly it can be embarrassing to show aspects of the school that administration refuses to deal with.

Caroline Scott, SUNY Cortland

I attend SUNY Cortland as a full-time student. I’ve been here for two years and attended SUNY Broome my freshman and sophomore year. When applying for college I didn’t know where I wanted to go, but I knew that I didn’t want to be that far from home. That’s why I decided on Broome because it’s about 30 minutes from home. I was able to live off campus and not commute so I was able to get a real college experience. After two years there I decided to go to Cortland because it was far from my home where I am able to be independent, but still close enough to go home if I need to. I am able to go to Cortland without having to have student loans because my parents can pay for it in full. That is a reason why I chose Cortland because I wouldn’t have student debt. Cortland comes with a lot of expenses though whether it’s parking, the price of textbooks (which I don’t always need), or materials teachers make us get outside of the classroom. My major is important to me so I will do whatever it takes to obtain my degree, but the price for many things have gotten out of control and I believe all SUNYs need to look at their finances and think about their students.

Ines Schmitt, Hunter College

I am a senior at Hunter College and a Psychology major. I am a mother of three going back to school now my children are grown up and would like to help young people since when I was young I didn’t have that support. I was at BMCC my first two years and I got my associate’s degree. It was really nice because I didn’t have to worry about the burden of paying for my tuition books and transportation since I had ASAP with an unlimited metrocard and I had an excellent adviser. Unfortunately when I transferred to Hunter I didn’t have the same experience with the advisement. They made me take a class that I already took in BMCC and I felt that the adviser didn’t take me seriously. I had to take that class online with 300 other students and I didn’t learn anything since the professor couldn’t take the time to explain. I think one of the changes that CUNY could benefit from is extending ASAP since it is a great program to hire more advisers that care about students instead of making it more difficult. Fixing the heating system since sometimes the professor had to let us leave because it was too hot and there wasn’t anybody to put the heating down. I think going to university shouldn’t be a struggle and administration should help us to navigate the system.

Maya Ranot, Purchase College

I am currently a Junior at Purchase College. I am a communications major with a minor in Psychology. I decided to major in communications because Purchase is a Performing Arts college so there wasn’t much for me, especially not much that I was interested in here.

I personally don’t pay for college, Foster Youth pays for my education and I am grateful for that. TAP is very helpful, however I feel like they can help out students more. My older brother was the first one in my family to go to college, however he didn’t get the chance to finish because he had to help pay bills. I will be graduating with my Bachelors in 2024. I luckily haven’t had any big challenges with paying for college because of Foster Youth. The financial aid awards I’ve gotten pays my tuition and food but not my daily living and other expenses such as money for textbooks. Textbooks are very expensive and sometimes I can’t afford them. Some professors also aren’t understanding of that and it can be frustrating. I live on campus however since I graduated high school in 2020, and that was the peak of COVID therefore we were the first ones affected by COVID first hand. I came to live on campus the second semester of my Sophomore year, like others in my class of 2024. I used to work Freshmen and sophomore year to cover expenses because I was living at home however once I got to campus I stopped to focus on school more and make it my priority. The only issues I’ve run into while registering for classes is not having many options and therefore having to settle for certain courses.

I personally feel like we need more of a variety because I’m not an art student here at SUNY Purchase College and this is a performing arts school. Advising for classes and navigating my way through college has been easy because I’m an EOP student therefore I get a-lot of help from my counselor every semester. I am very thankful for that and I have come to realize that students don’t have the support system in college and they all deserve to have that. College is not easy, especially when you have no support system.

Elianny Duarte, SUNY Cortland

I am a full time student at SUNY Cortland. I am a senior majoring in Sociology with a concentration in Criminology and a minor in Spanish. I am from the East side Bronx, NY. I come from a single-parent family of 4. When applying for college, I was accepted in different schools and I had different options. However, I was only able to apply to SUNY or CUNY schools because that was all my mom was able to afford and barely. I always wanted to go away for college and one day my high school took us on a school trip to come visit SUNY Cortland and ever since then I started seeing it as an option. I fell in love with the Student Life Center and the peaceful environment at SUNY

Cortland so I decided to commit it to the school. I pay for tuition through the help of financial aid and student loans. Most of my tuition is paid through financial aid, which is helpful, but it is still not enough. Being able to pay my student loans is something that concerns me the most. I used to have two jobs. During the summer and winter breaks, I work almost every day to help pay for my personal expenses, and I also have a part-time job at school, but it’s not nearly enough to save for my student loans. My mom tries her best to help but there is so much she can do as a caregiver of a single family. I believe college should be free for low income families. Since attending college is almost required in today’s culture in order to secure a well-paying career, I don’t think it’s fair that tuition is so expensive. Students must also pay for their textbooks each semester in addition to tuition. I firmly believe that textbooks should be covered by tuition even if they may cost several hundred dollars.

My family and I experienced some difficulty during the epidemic. My mother sadly lost her job during COVID-19. The amount of government assistance we received to support our family of four was not enough. It was challenging for a while, and there was even a point when I believed I would have to return home to finish my education. I believed that I would never be able to go to school since money was so tight. I used the majority of my funds to assist my mother with her bill-paying. Nevertheless, I was able to get a job online and assist my mother for the rest of the year.

Having a college degree is very important for me because it won’t only allow me to have better paying jobs, but it would also allow me to help my family get out of poverty. One of my biggest concerns is having to pay student loans for the rest of my life. I am hoping that one day everyone is able to attend college without having to worry about money.

Mary Avella, Hunter College

I am a junior at Hunter College from Staten Island. I constantly have to walk up flights of stairs to meet with professors for office hours because the elevators don’t work. I can’t buy textbooks on the Hunter website because they are so expensive. Hunter doesn’t have enough funding for adequate COVID testing and coming back to school was terrible. The online classes were terrible. We don’t have enough options for disabled people. After many years of fighting, we are finally just able to get an elevator in the subway. While I pay out of pocket for school, I know others who are struggling and in need of help.